Lack of EPR preparedness laid bare in a new survey

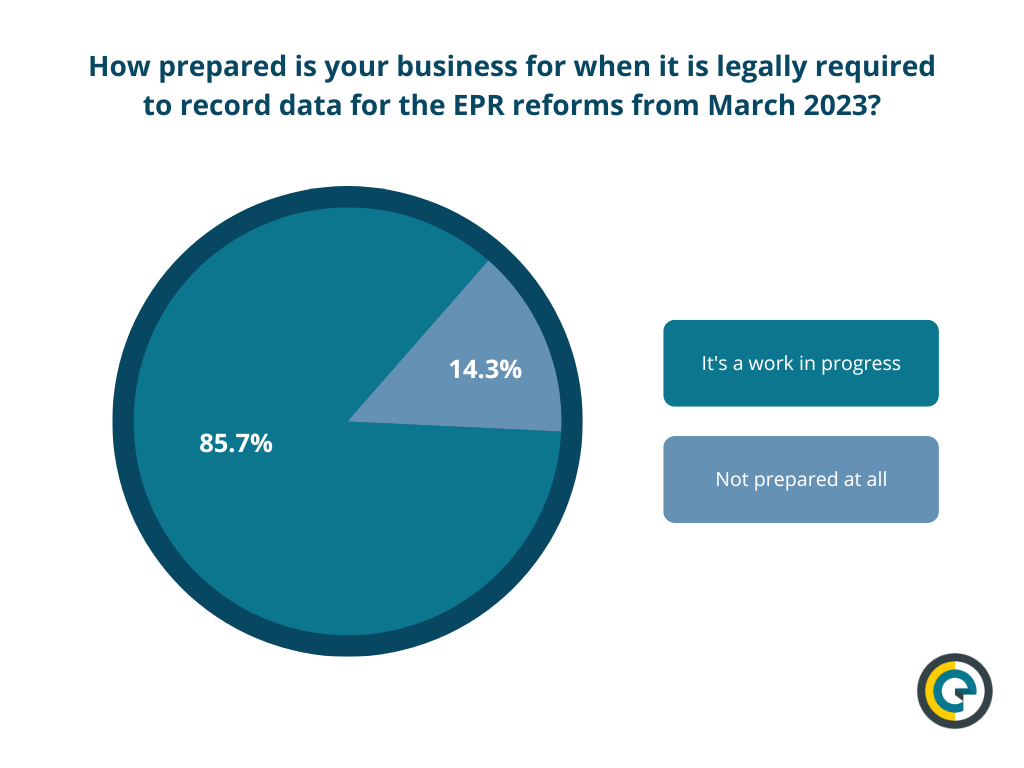

The vast majority of UK businesses view their packaging data collection capability as a “work in progress”, according to a new survey by environmental compliance data experts, Ecoveritas.

A staggering 86% of respondents are yet to establish their data collection processes fully, despite the strengthening of a statutory instrument (SI), titled Packaging Waste (Data Reporting) (England) Regulations 2023, which mandates obligated producers in England to collect and report data on the amount and type of packaging placed on the market from this month.

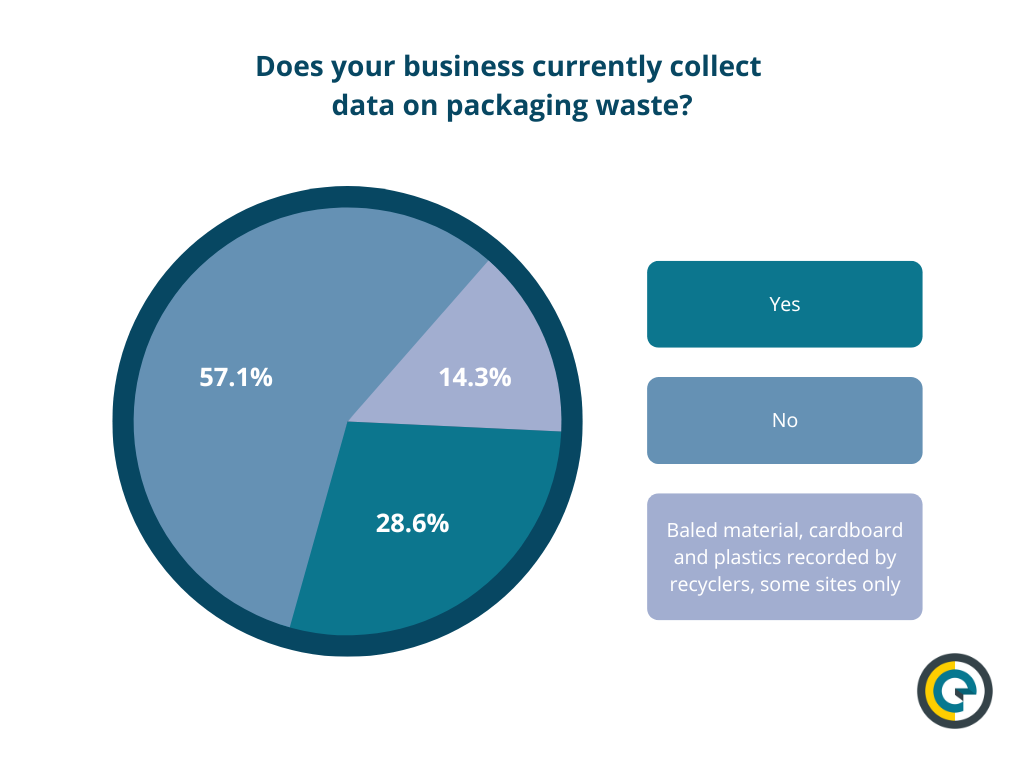

57.1% of respondents, or three in every five businesses surveyed, do not currently collect data on packaging waste – let alone report on it.

The news comes as Defra (the Department for the Environment, Food and Rural Affairs) said Extended Producer Responsibility (EPR) is still on track to be delivered in 2024. Still, it will remain in talks with producers as the “final design of the scheme and delivery plans are developed”.

This week, the British Retail Consortium said that the EPR and Deposit Return Schemes combined would “add around £4 billion in costs to retailers”, which will be passed down the line.

With growing concerns around inflationary pressures, 85.7% of respondents are concerned about the financial implications for their businesses.

“Firstly, we’d like to thank all of the businesses that took part for doing so,” said Chief Strategy Officer Andrew McCaffery. “We continue to have so many new conversations with people looking to future-proof their business.

“Businesses need a modern and flexible range of partners who can support them on the journey and advise them as they go through it. Needs can change over time, but those core processes of bringing things together to make better decisions will always be important.

“Many businesses face big data challenges when understanding their compliance obligations for a geographic region. While some countries request no or limited data and financial contributions relating to EPR, others often require detailed data submissions. This means if you don’t have the necessary data, or it is not precise enough, there could be large cost implications at stake.

“SMEs, in particular, who are getting captured by the regulations will struggle to rise to the challenge more than large companies with the resources to engage. Individual obligated companies’ compliance costs could increase between six and 20 times depending on the final design of the new system.

“It’s fair to say that preparedness is significantly lacking for many reasons. However, the direction of travel is clear, despite not reaching a full understanding and consensus. We advise engaging with your peers, suppliers, trade associations and organisations such as ours to ensure you hold live and accurate packaging specifications.”

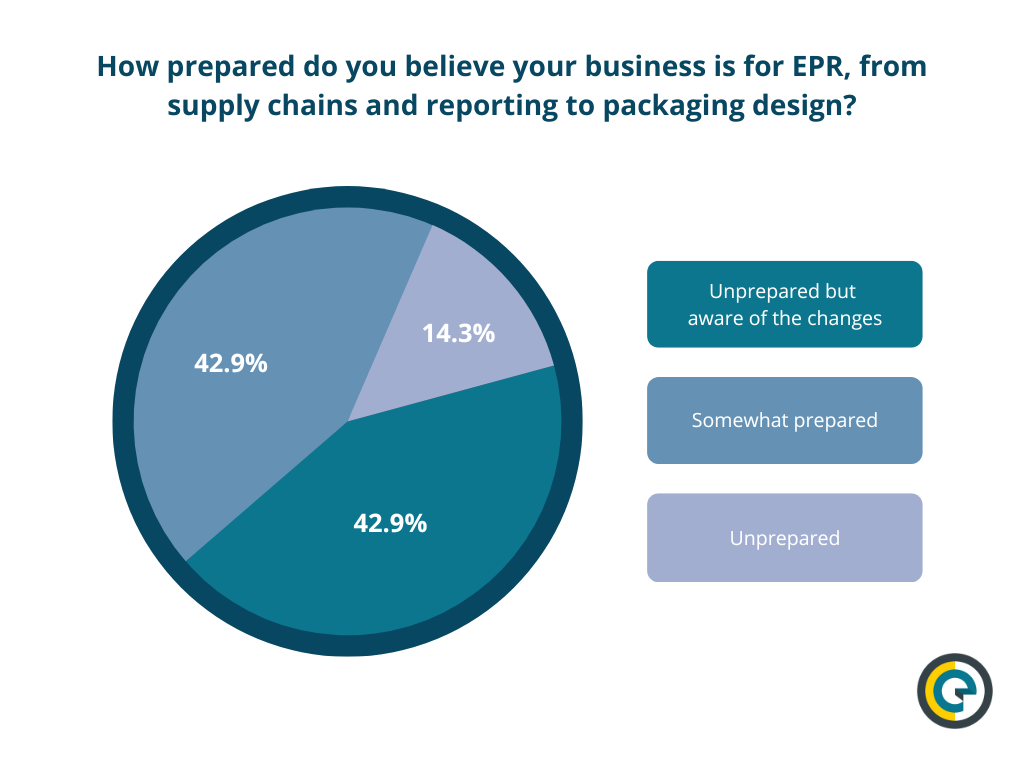

Having canvassed the sector’s opinion on pEPR last month, 42.9% of respondents rated themselves as unprepared but aware of the changes, regarding their general preparedness for the upcoming reforms. 14.3% of those responding admitted to being unprepared.

85.7% of businesses rated the government’s communication quality around the legislative changes to packaging regulations between one and two, on a sliding scale of 1-10, where one is poor and 10 excellent. 100% rated it lower than four.

Regarding preparations for 2024, over half of the businesses surveyed have yet to make plans, with the remainder internally resourced, 14.3% of which will rely on external software/systems.